Td commercial mortgage calculator

Use the mortgage affordability calculator above to figure out how much you can afford to borrow based on your current situation. CanWise Financial CanWise Mortgages are owned and operated by Ratehub Inc.

Tumblr Commercial Loans Small Business Loans Business Loans

With over 12 years of mortgage experience and 11 billion in mortgages funded we deliver you the best mortgage experience in Canada from online search to close.

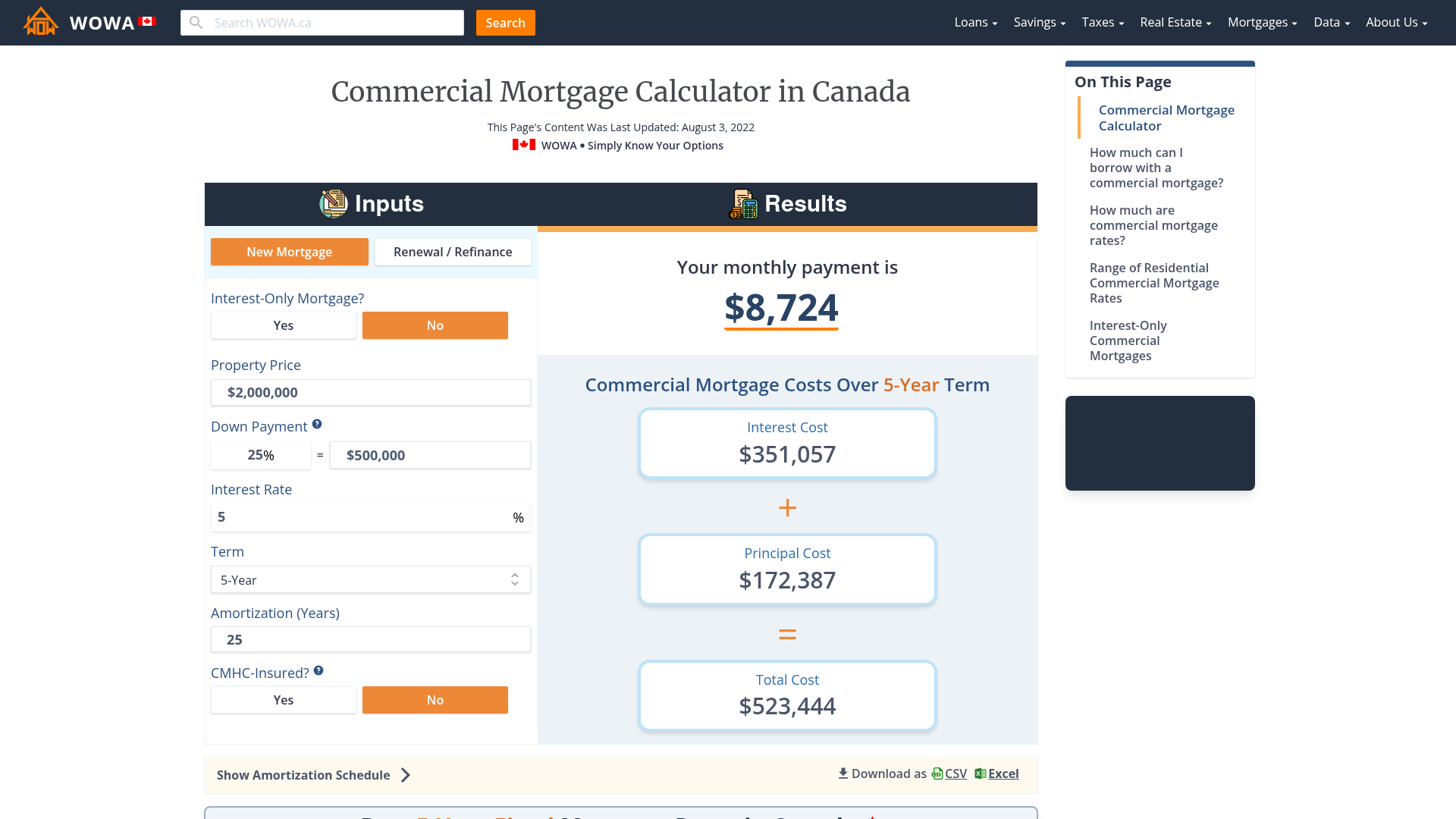

. If youre looking for this type of mortgage a TD Home Equity FlexLine may be available to you. Theres more than one kind of small business loan. The TD Mortgage Payment Calculator can help you better understand what your payments may look like when you borrow to buy a home.

A second mortgage refers to additional financing that would be in second priority to the already registered mortgage on the same property. To use our mortgage affordability calculator simply enter your and your partners income or your co-applicants income as well as your living costs and debt. A mortgage pre-approval is an important part of the home buying process.

Debt Consolidation Loan Calculator. TD Bank is the US. Deciding why you need financing will help you choose the right kind of loan.

Best Small Business Insurance Commercial Auto Insurance. Decide Why You Need Financing. For example if the TD Bank prime rate is 300 and your mortgage.

Only and bring it to your nearest TD Bank. Thats double your normal payment amount. Use ourTD mortgage calculators to calculate your mortgage payments.

Ratehubca has been named Canadas Mortgage Brokerage of the Year for four years straight 2018-2021. Become a more confident first time home buyer and find comprehensive resources tools and information. TD Wealth Private Client Group.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Discover how to get a great commercial rate and borrow at a high LVR. If you are pre-approved it means that a lender has stated that you qualify for a mortgage loan based on the information you have provided and subject to certain conditions.

Buying your first home is an exciting journey. Featuring TD Canada Trust online banking. Ontario Mortgage Brokerage 12530 Quebec Ratehubca Mortgage Brokerage Firm 3001931116 - Ratehub Inc.

How the TD Bank prime rate affects variable mortgage rates. Download your small business loan application US. Our mortgage calculators can help you discover the estimated amount for your monthly mortgage payments based on the mortgage option you choose.

Use our tools to find the best mortgage solution that works for you and compare options. Commercial banking arm of Canadas TD Bank Group. Any investment income earned on investments held within the plan is tax-deferred as long as it remains in your RRSP.

Navigating the commercial property loan market can be tough. You can carry forward your unused RRSP contribution room from years of lower. Commercial office loans are a very common type of commercial loan.

TD Bank Commercial Banking. Try our vehicle loan calculator to see how much your monthly payments could be. This move follows a 75 basis-point hike in.

For private sale vehicles 2. Compare what you might be paying with a loan vs. As of June 8th 2022 the TD Bank mortgage prime rate is 385.

A mortgage payoff calculator can help you. Your RRSP contributions are tax-deductible and may help to reduce the total amount of income tax you pay. TD Bank Promotions.

When you get a variable mortgage from TD Bank the interest rate will be expressed as the TD Bank prime rate plus or minus a certain percentage point. This is part of your down payment paid when you make an offer. If that doesnt fit your finances a high-ratio mortgage may be available with a down payment of at least 5.

Customers have access to mortgages deposit accounts. This applies to TDs 6-year fixed-rate residential mortgage whereupon TD will give you cash in an amount equal to 5 of the mortgage principal up-front. A line of credit.

How to refinance your mortgage. Whatever the amount make sure youre comfortable with it and able to provide it quickly. Change your mortgage loan type If you have an adjustable rate mortgage ARM and are concerned that your interest rate and monthly payment might increase refinancing to a fixed rate mortgage can provide a stable monthly.

In order to get. Lending policies arent black and white so it pays to go with a commercial mortgage broker. Green Mortgage The Green Mortgages makes you eligible for a 1 discount off the posted interest rate and up to a 15 cash rebate when you make ENERGY STAR-qualified purchases or the purchase.

With TD you can increase your original scheduled principal and interest payments by up to 100 during your mortgage term. We offer financing options for new or used cars SUVs trucks vans and recreational vehicles that are sold privately or through dealerships. A potential downside of reducing the mortgage term the length of the mortgage loan is an increase in the monthly payment.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Oa Ratehubca CanWise Financial is a licensed mortgage brokerage and CMHC-approved lender. For example if you typically pay 1000 a month you can increase your payment up to 2000 a month during your mortgage term.

Loans under 100000 Loans over 100000. On July 27 the Federal Reserve announced another big rate hike raising the federal funds rate by 75 basis points bps to a range of 225 to 25. TD Canada Trust products and services include investing mortgages banking and small business.

TD has a range of ways to help you get the money you need. Connect with TD and let a TD Mortgage Specialist help you find a mortgage solution that best suits your needs. Self-directed RSP mortgages and mortgages on commercial properties are not eligible to be insured.

A mortgage pre-approval often specifies a term interest rate and principal amount. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. Whatever your purpose we have the advice and solutions to help you borrow confidently.

Plan for an amount of at least 20 of the purchase price. How does Ratehubca make money. Mortgage refinance calculator.

How to use the mortgage affordability calculator. With a few key details the tool instantly provides you with an estimated monthly payment amount. A Home Equity Line of Credit HELOC is a typical choice for a second priority mortgage.

How Do Mortgages Work Td Bank Lending Tips

Td Canada Trust Mortgages Calculators And Tools

Bfiltqjc Ibeqm

Online Mortgage Journey Td Canada Trust

Mortgages For Physicians Doctors Dentists Surgeons Td Bank

Mortgage Offers Td Canada Trust

7 Things I Always Buy At Bed Bath Beyond Bed Bath And Beyond Yankee Candle Store Bed Bath

What Happens If You Break Your Mortgage Td Canada Trust

Mortgage Renewal Tips Td Canada Trust

How To Buy Your First Home Get Your First Mortgage Td Bank

How Much Will It Cost To Break My Mortgage With Td Bank Ratehub Ca

How To Buy Your First Home Get Your First Mortgage Td Bank

How To Buy Your First Home Get Your First Mortgage Td Bank

How Much Will It Cost To Break My Mortgage With Td Bank Ratehub Ca

Longer Vs Shorter Mortgage Amortizations Differences In Costs Cashflow Affordability

Mortgage Renewal Tips Td Canada Trust

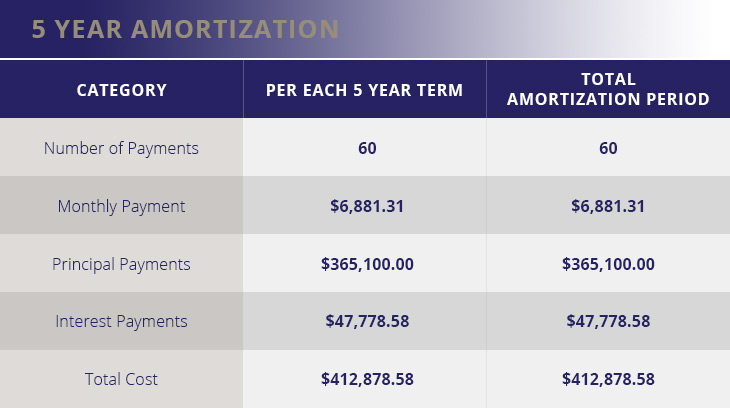

Small Business Loan Calculator Td Bank